Tracking the federal government's relentless march to bankrupting the country.

Will anyone be held accountable? As of January 2023, no.

(5/7/23)

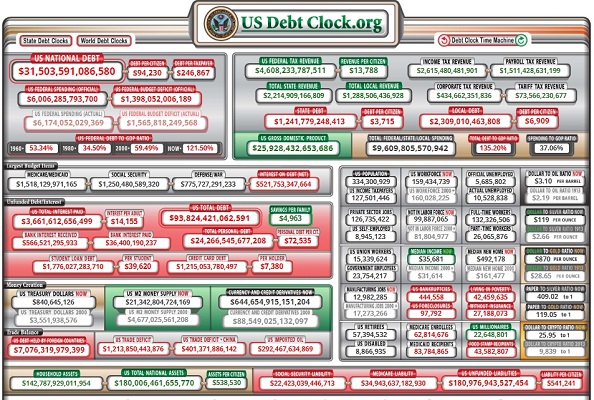

As another debt ceiling confrontation approaches there's no doubt that the march towards a federal bankruptcy will continue. The voices calling for sanity and the need to rein in federal spending will be drowned out by the cries that the debt ceiling must be raised. It's the same argument over and over. "We have to raise the debt ceiling. The U.S. cannot default on its debts. We have to pay our bills. Etc." And that's true. The bills are due. How many overdue notices will the nation ignore before getting its financial house in order? The problem is that all the money that the federal government has raised over the years through taxes, and fees, and borrowing has been spent. All of it. And as a result the federal government is in debt to an acknowledged amount of $32,000,000,000,000 ($32 TRILLION!). What's not acknowledged are the unfunded liabilities that the U.S. federal government has made in promises amounting to well over $100 TRILLION more. Irresponsible federal spending has been going on for decades and the numbers only get worse as the Congress and Administrations, both parties, continue to "kick the can down the road." Well, we're running out of pot-hole riddled road. President Reagan touched on the topic during his 1985 Inaugural Address.

However Reagan, too, watched the federal government grow under his Administration. When will we tap the brakes?

______________________________________________________________

(2/26/23)

It truly is shocking how irresponsible the U.S. federal government is managed. Also shocking is how the people bankrupting the country continue to get re-elected. In most cases easily re-elected. But, now even the ultra liberal news media in this country is beginning to, grudgingly, acknowledge that, "yeah, these federal spending and projected debt levels aren't sustainable." Ya think? Brace yourself, they're even admitting Social Security and Medicare are in trouble.

______________________________________________________________

(1/21/23)

Well, there's lots of fretting in DC, and on Wall Street, and throughout the rest of the country now that the federal Debt Ceiling has been reached, again. The Democrats are howling about how "irresponsible it is to not raise the Debt Ceiling." Apparently, it wasn't irresponsible to amass over $31 TRILLION in debt and ignoring the multiple tens, if not hundreds, of TRILLIONS in unfunded federal liabilities. I disagree. It was utterly and totally irresponsible to bankrupt the country, and both parties are responsible for being irresponsible. Now we're in the bind that many of us have been predicting for decades. Fox News provides a glimpse of the irresponsibility we face.

Should Republicans continue the standoff or simply raise the debt ceiling and go along with the nonstop federal spending spree? Of course, if they do all of the dreadful numbers we see today will only continue to get worse. The Democrats don't care that the federal government has spent every tax dollar it has collected and is on the hook for hundreds of TRILLIONS more. They simply don't care. The spending has given them political power and the news media will side with them while portraying Republicans as the uncaring party wishing to make the lives of Americans more burdensome. It's a difficult situation for Republicans who want to do the right thing but are faced with the reality that America and most Americans wish to continue to live beyond our means.

______________________________________________________________

(10/14/22)

(10/14/20)

The bankrupting of the U.S. is in high gear, as Stephen Moore at Prager University explains:

(6/17/20)

Here's yet another example of why the U.S. Federal Government is headed for what I call "Fedruptcy" - Bankruptcy of the Federal Government. This "economist," Vijay Mathur, is informing us that we're misinformed. He actually wrote this in the Standard-Examiner: "Misinformation and lack of full information confuses many Americans. For example, many think that the federal government prints money to finance the debt - far from the truth. The Federal Reserve controls the money supply, including the currency, but it only replaces old worn out currency if needed." So, the Federal Reserve "only replaces old worn out currency"? What seems to be ignored in Mr. Mathur's analysis is, where does the Federal Reserve get the money to buy U.S. Treasury debt instruments? The Federal Reserve simply enlarges its balance sheet. It is all done on credit. The Fed apparently has an unlimited credit card on which it is taking on debt. At some point it won't be able to do so.

(5/2/20)

I missed this story when it was first reported. The StarTribune reported in September 2017 that "Minnesota's public-pension system is in crisis, new data shows." We have to address this situation sooner rather than later. Minnesota isn't unique facing the underfunding of its public-pension programs, it's situation pervasive throughout the U.S. We're kidding ourselves if we think this situation is simply going to disappear. Step one: Start using conservative estimates in financial projection models. Expecting 7-8% annual returns, especially with today's highly volatile markets, is foolish. Let's stop being foolish.

(4/19/20)

In a case of "Duh"! The Washington Post is reporting ...

The problem with this story is that the WP uses "Risks" in the headline while one of the economists quoted in the article concludes the United States is in a "debt trap." We don't "risk" a point of no return. We're rapidly reaching it, if we haven't already.

(4/1/20)

From MarketWatch: "Trillions in coronavirus spending could explode deficits to World War II levels." Simply dreadful, but needed to win a "war" against an unseen enemy - a virus that has rapidly spread throughout the world. Yesterday's briefing at the White House to update the country on progress being made to confront the "Coronavirus" was somber and fact-filled, and it also related the seriousness of the situation the country/world faces. The ever-optimistic President Trump reflected a mood that can only be described as worrisome. He said the country would experience a very bad two to three weeks with deaths from the Coronavirus projected to be between 100K-240K. That is what has led to the decision to extend federal guidelines to continue "social distancing" and initiating "stay at home" orders throughout the country. We hope the projections are wrong, but we need to be braced for the worst.

(2/11/20)

Rightly so, The Hill is reporting that the Federal Reserve Chairman has issued a "stark warning" to Congress on the dangers of continuing massive federal budget deficits. This issue is no where to be found on any radars in Washington. This was a huge issue during the Bush/Obama years. The country is on a sure course toward "Fedruptcy." It is only a matter of time until we arrive there.

(12/16/19)

Tom Horner has an OpEd in today's Star Tribune that should be required reading for all legislators at all levels of government in the United States - federal, state, county, and local. Horner has titled his article "America's ruinous debt still matters - or should."

(10/26/19)

The "Bad News" continues for the country's financial status. This article by Heather Long and Jeff Stein at the Washington Post provide the ugly details as

deficits are again approaching $1 TRILLION per year!. Critics of President Trump are quick to point out this is a campaign pledge that the President hasn't fulfilled. They're right about that. Objective critics would recognize what the President has been up against in trying to get anything done. Right now they're trying to impeach him. Weren't Democrats in Congress threatening to shutdown the federal government if President Trump cut any federal spending? And aren't the Democratic candidates running for President now promising to, if elected, spend tens of TRILLIONS of dollars that the country doesn't have for the social programs they are proposing? The country is on the road to Fedruptcy and the Democrats are stepping on the gas. Wait a minute, they hate so-called fossil fuels. Maybe it would be more appropriate to say they're willing to blow up the budget.

What we see is the MSM touting President Trump not bringing the budget deficit down, but on the other hand openly supporting candidates who pledge to make the nation's debt much worse.

(8/29/19)

The national debt is now 110 percent of the USA's GDP, the largest ratio since World War II.

(7/12/19)

The United States financial situation continues to deteriorate despite what the stock market records indicate. As records are being set on one front (Stock Markets setting new highs) other records are being ignored (Budget Deficits and the National Debt are soaring). Here's the situation as of 12 July 2019.

(6/19/19)

This is most disconcerting. This issue is critical and unfortunately "Deficits are exploding and neither party seems to care".

(5/17/19)

Townhall's Brian McNicoll reports, the U.S. Postal Service is bleeding red ink and may soon require a bailout. This is one agency that charges customers a fraction of the cost of delivering its product to customers. How much first class mail is actually delivered these days? How much is direct mail/marketing materials where pennies are charged per item versus $.55 per first class letter? Step one: Stop Saturday mail delivery. Step two: Start charging what it costs to deliver mail.

(3/21/19)

Townhall's Brian McNicoll reports, USPS Could Need Bailout in 2 Years or Less if Fiscal Problems Not Addressed.

(3/10/19)

The Associated Press' Andrew Taylor reports, "As budget deficit balloons, few in Washington seem to care." This country had a General Election four months ago and this situation was not debated, not one iota. We're witnessing fiscal malfeasance on a scale that's approaching indescribable. Too few in Washington seem to care. Worse, too few in the country seem to care.

(3/6/19)

Red Flags everywhere! This is the climate we have to change.

(3/2/19)

The US just officially hit the debt ceiling, setting up another high-stakes showdown for the fall. President Trump, the country's southern border is a major problem, no doubt about it, but the Federal Government's debt level is a bigger problem. It is critical that there be an equal amount of urgency in addressing the exploding debt. And this is happening on your watch. One of your campaign pledges was to get the country to a balanced budget. No question Congress for decades has failed us and has been irresponsible in handling the country's finances. It's going to take a grown up, someone who is prepared to make the tough decisions to right this listing ship. You're in the office that can start doing the right thing -- balance the budget!

(2/19/18)

AFP, the Agence France Presse, reports "US debt hits record under Trump, Republicans mum." No argument there.

(2/13/19) - USA Today reports the National Debt tops $22 trillion for the first time. This is not good, and it has conservatives wondering how it is that $2 TRILLION has been added to the national debt in two years when we were led to believe we would be headed to a balanced budget under President Trump? I blame Congress more than the President because he inherited a bloated federal budget that has automatic spending built into it. Any efforts he would make to cut spending would be met with Congressional stonewalling and demogoguery. We, as a nation, will have to deal with this dire situation at some point.

(10/2/18) - US budget deficit expands to $779 billion in fiscal 2018 as spending surges.

(10/2/18) -

It grows and grows ... and grows. Is there anyone campaigning who is talking about this? We are a month away from the mid-term General Election and this issue is completely off the table. Remarkable. And Republicans are proving to be just as irresponsible as Democrats when it comes to managing the federal budget.

(9/26/18) - As Debt Rises, the Government Will Soon Spend More on Interest Than on the Military, CNBC's Nelson Schwartz has the details.

(9/3/18) - Global debt soars, along with fears of crisis ahead, as the Washington Post's David Lynch reports.

(8/11/18) - Interest on the National Debt hits all time high.

(7/27/18) - Not only is the federal government drowning in debt, many states are in bad shape too.

(5/20/18) -The latest evidence that key members of Congress have "given up" on addressing the nation's mounting national debt comes from Tennessee Senator Bob Corker. Townhall's Cortney O'Brien has the details.

(4/13/18) - Former Speaker John Boehner: Deficit will be 'No. 1 issue' in six months. Well, we certainly know it wasn't an issue while Mr. Boehner was House Speaker. He was Speaker as President Obama was busy doubling the national debt during his two terms in office. And Republicans now are continuing the bankrupting of the country. It's just awful.

UPDATE: It's October 15, 2018. Are any of the candidates for federal office talking about the growing national debt? If they are we aren't hearing it.

(3/16/18) -What's this? The National Debt has hit $21 TRILLION just six months after it first hit $20 TRILLION? How is this possible if the claim is the federal government is running a half TRILLION dollar annual deficit? This doesn't add up. Well, it does add up and that's the problem. The debt keeps compounding and the country is pouring more debt on top of an already staggering debt. This is not good.

(2/16/18) - How bad is the debt situation? The Market Place's Lizzie O'Leary and Paulina Velasco pose the question, "Should you worry about the national debt?" My answer: Most definitely we need to be worried about the compiling national debt. We aren't going to get out of debt by taking on more debt. Pretty simple.

(2/16/18) - There is at least one Treasury official expressing alarm at the rising debt. The Hill has that story.

How Bad Is the Crisis in Illinois? It Has $14.6 Billion in Unpaid Bills

$20 trillion debt deserves as much attention as Dow hitting 20,000 (New York Post) Yes it does!

The Debt Limit Returns!

The Current National Debt Level is Click here!

The National Debt Level at 8:30 a.m. on January 25, 2017, five days into President Trump's Administration.

Debt Clock History

Federal Budget Components

Who owns U.S. Debt? Here is the list of countries owning U.S. debt.

The Chronicles:

Climate Change!

Liberties Lost!

Government Waste!

OpEd-A Front-Row Seat to Detroit's Bankruptcy by Bill Nojay for the Wall Street Journal.

I'm back! "Fedruptcy" is derived by a combination of the words "Federal" and "Bankruptcy." Federal can be applied to the entire Federal Government, however, this site will focus primarily on the actions of the Federal Reserve and the cause-effect relationship its actions have had, are having, and will have in "bankrupting" the United States. The United States is clearly on this path now. This site is intended to be an aggregator of public information that synthesizes the data, the political spin, and the reporting that is obscuring the financial condition of the United States and the world's economy.  "If you cannot identify your enemy you cannot defeat him." "If you cannot identify your enemy you cannot defeat him." News & Analysis (8/21/13) - Analysis: It should be obvious that the books are being cooked within and between several federal agencies and quasi-federal agencies. This Los Angeles Times story headlined "Fannie, Freddie delaying write-offs" details the latest example of such cooking. Any objective reading and understanding of the information contained in this article will highlight what is going on. (8/2/13) -The Federal Government (Labor Department) has released Unemployment figures for July. The Department reported 166,000 jobs were created in July and that the Unemployment rate for the month declined from 7.6% down to 7.4%. A look at the numbers shows this. Note the number of people who left the work force (240,000) is more than the number of people who apparently found work (227,000). The number of Unemployed is reported to have dropped by 263,000. What should get attention is that nearly 90 million people are considered "Not in Labor Force." With the total U.S. population as of July 1, 2013 being 316,364,000, that means when you combine the 90 million people who are "Not in the Work Force" with the 70,608,000 others who are retirees, children, or incarcerated, more people are not working than are. (8/1/13) - This is a curious situation. The National Debt has been stuck at exactly "$16,699,396,000,000" for 70 Days. As The Blaze reports the reported debt level hasn't changed since May 17th. One would think there would be at least one inquisitive journalist in the Mainstream Media who would ask the question, "What's up with that?" Clearly, something is amiss with the reporting (nonreporting) of this information. When a Treasury representative was asked about this the answer given was the Treasury Department has informed Congress that it is taking "extraordinary measures" to fund the government. Well that certainly explains what's going on. Transparency is nonexistant despite pledges to the contrary. (7/21/13) - Cyprus Update - Reuters is reporting the Cyprus Banks "Bail-in" has been set at 47.5%. What does that mean? According to Reuters, "Cyprus and its international lenders have agreed to convert 47.5 percent of deposits exceeding 100,000 euros in Bank of Cyprus to equity to recapitalize it." Here's the story:

Why is this important for Americans? It is important because "International Bankers" have decided it is okay for central banks to steal money from depositors in order to keep banks solvent. It will be argued that such action is "for the greater good." In the case of Cyprus, nearly half of a person's savings account over 100K Euros can be confiscated for use by banks. When the U.S. federal government and the banking system faces collapse here there will be precedent to point to as an "option" to consider in dealing with such a crisis in this country. (7/21/13) - This has been a big week for bankruptcy news. The fallout from Detroit's filing for bankruptcy surprised few who follow these situations. What has been instructional is how the President and his Administration raced to the White House Press Room on Friday to announce that Obama could have been Trayvon Martin 35 years ago. Some skeptics have declared this to be nothing more than trying to change the subject. It is a good thing he warned politicians to butt out of what happened after a jury heard the evidence and rendered their decision. Now we discover: As the Detroit Free Press reports . . .Detroit is not alone under mountain of long-term debt! Actually, we knew that, but it is encouraging that more people are beginning to learn of this. We can't wait for Paul Krugman's explanation as to what went wrong. Let's guess. The problems Detroit faced is that they didn't spend enough. If only they had taken on more debt. That is after all his prescription for the national debt. And then there's this: The Christian Science Monitor wonders if what happened in Detroit could be a prelude to what happens to the country? Could how Detroit and Michigan navigate their seismic changes hold lessons for the country? Jumping to the bottom line the answer is yes. Before today ...... (7/18/13) - It's official: Detroit is bankrupt. The story from the Detroit News. Few are surprised by the announcement considering the lead-up to today's announcement. Detroit officials are indicating a federal government bailout is needed. It will be interesting to other cities (and states) in similar predicaments as Detroit as to how the federal government responds to this situation. It will be interesting because the federal government is in worse shape financially than is Detroit. The federal government's debt dwarfs what Detroit owes. Add in the government's unfunded liabilities and the situation is that much worse. Sadly, conservatives see this but are currently powerless to stem the rising tide of debt and the disaster it brings. The President has been on top of this situation. Remember this statement?

Oops. (7/18/13) - The website "Governing-States and Localities" is tracking cities and local units of government that have declared bankruptcy (some of the petitions have been dismissed by the courts). This list will undoubtedly grow in the coming months and years. (6/29/13) - The Financial Times is reporting "Central banks sell record sums of US debt". Why? Markets are shuddering at the thought the U.S. Federal Reserve is hinting it may soon ease its "Quantitative Easing". Translation: The funny-money-based stock market rally's drive will also be "eased." (6/17/13) - Detroit is on the path to bankruptcy. The Huffington Post reports the city is beginning to withhold payments to bondholders. (5/1/13) - California's Debt situation is coming into focus and it is worse than has been reported. The Sacramento Bee is estimating California's debt burden could exceed $1 TRILLION. (5/13/13) - The city of Detroit is broke. The story from the National Review. (4/17/13) - Time Magazine has an article in its April 17th issue that goes right to the heart of the dilemma that this site is all about. It is titled, "Why the Argument for Austerity Took a Big Hit Yesterday." It is written by Christopher Matthews. Unfortunately, the article doesn't answer the question about how much debt governments can safely take on, but it provides insight into the arguments made by pro-debt advocates that we can take on more than we have. Mr. Matthews seems to have missed data that reveals the current U.S. Debt-to-GDP Ratio is 101%, not the 73% that he reports. (See chart to the right.) (4/11/13) - Federal Housing Administration May Need Bailout, the Washington Post reports. (4/8/13) - Portugal Considers Paying Public Workers In Treasury Bills Instead Of Cash. The story from Zero Hedge. The significance of this: Governments could decide to issue debt instruments to employees instead of paychecks, in other words "IOUs". (4/5/13) - Fascinating. The Financial Times is reporting that David Stockman, the man who was at the front of formulating President Ronald Reagan's budgets during this first term, is taking fire for having the nerve to state what has created our nation's massive debt. (4/5/13) - People Not In Labor Force Soar By 663,000 To 90 Million, Labor Force Participation Rate At 1979 Levels. The MSM will tout that the Unemployment Rate dropped to 7.6%, largely ignoring the main reason for the decline -- millions of Americans have chosen to stop seeking work. (4/5/13) - Obama proposes cuts to Social Security. The story in today's StarTribune. Typical Obama tactic: Publicly accuse Republicans of one thing and then quietly implement their proposals to rein in out-of-control government spending, and yet still be positioned to blame Republicans that it is their ideas. Notice how it is portrayed that the President is doing this as an attempt to reach compromise. (4/5/13) - Another influential European Banker has said it is okay to seize uninsured deposits in order to save failing banks. The contagion that is spreading among European bankers is that it is permissable to take what isn't theirs in order to save their institutions. Will such thinking spread to the U.S.? (4/4/13) - Jobless Claims last week at 385,000. (4/1/13) - Stockton, California has been cleared by a court to declare bankruptcy. The story from the Los Angeles Times. Think of it as the canary in the mine shaft. It has begun.

(3/28/13) - MARC FABER: Not Even Gold Will Save You From What Is Coming. The story from Business Insider. (3/28/13) - Cyprus Banks Reopen With Capital Restrictions. Customers descend on bank branches as they open for the first time in almost two weeks - but tough rules limit withdrawals. The story from the UK's SkyNews. (3/26/13) - Despite predictions to the contrary, actions taken in Cyprus to prevent a banking system collapse in that country will not be isolated. A senior Eurozone official has announced savings accounts in Spain, Italy and other European countries will be taken if needed to preserve Europe's single currency by propping up failing banks. (3/13/13) - ABC News reports President Obama downplays the debt situation. (2/8/13) - Voter Fraud that never happens keeps surfacing. Today's highlight: Ohio! (2/8/13) - Navy delays refueling aircraft carrier -- budget uncertainty. Commentary (2/11/13) - Obama to circumvent Congress to advance agenda (2/9/13) - Federal employee union balks at pay raise (1/16/13) - The White House increases the number of signatures required for petitioners to receive an official response to questions. This is what is considered to be part of the non-transparency movement that is underway. This site is paid for by Americans concerned about the future of the United States.

It is not approved or coordinated with any candidate or candidate's committee. | | January 24, 2015: The Current National Debt Level is Click here!

Debt Clock History Federal Budget Components

Who owns U.S. Debt? Here is the list of countries owning U.S. debt.

Obama Speaks on Debt - Remember this classic? "The problem is is that the way Bush has done it over the last eight years is to take out a credit card from the Bank of China in the name of our children, driving up our national debt from $5 Trillion from the first 42 Presidents, number 43 added $4 Trillion by his lonesome so that we now have over $9 Trillion of debt that we are going to have to pay back -- $30 Thousand dollars from every man woman and child. That's irresponsible. That's unpatriotic." And what has he done all by his lonesome? See the data above. Archives

COMBAT-The Collective Speaks |